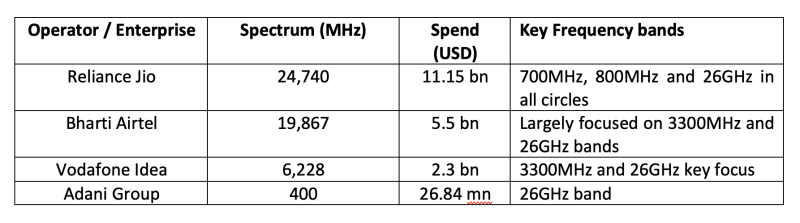

India announced the conclusion of its mega 5G spectrum sale yesterday, with the service providers shelling out $18.9 billion for spectrum in the 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz and 26 GHz frequency bands.

The 3300 MHz band generated the maximum amount of INR 805.9 billion ($10.25 billion), followed by 700 MHz, which contributed INR 392.7 billion ($4.99 billion) to the government’s kitty. This was followed by the 26 GHz band, which received bids worth INR 147 billion ($1.87 billion) and the 1800 MHz band, which attracted bids worth INR 103.76 billion ($1.32 billion). The spectrum in the 800 MHz, 2500 MHz, 900 MHz and 2100 MHz contributed the rest. In total, 71% of the total spectrum on sale was sold in the auction.

Here are the key highlights from the spectrum auction:

1. Jio bets on 700 MHz spectrum

As expected, Jio spent the maximum and surprisingly acquired pan-India spectrum in the 700 MHz frequency band. This spectrum was available in the previous two auctions in 2016 and 2021 but high reserve price meant that it was not picked by any telco.

“700 MHz band could potentially give R-Jio an edge in terms of network quality, especially indoors, and this could increase investors’ concerns on further spectrum outgo for Bharti if R-Jio were able to offer significant differentiation in network quality (vs Bharti) with 5G on 700 band,” says a note issued by Nomura Market Research.

Analysts believe this could give it a major advantage compared to its peers and may even help it to acquire high-end customers, which is its biggest pain point.

“With Jio acquiring 700 MHz, we believe that the company is well placed to roll out standalone (SA) 5G. The advantage of SA 5G is that the company would be able to offer true low-latency applications, such as slicing. This is difficult for its peers to offer given the lack of spectrum (telcos cannot roll this out on 4G bands),” says a BofA Global Research note.

“From a purchasing power parity (PPP) perspective, 700 MHz pricing looks expensive for India, but it gives Jio a massive first-mover advantage in SA 5G rollout, which could help it poach high-end customers from peers,” adds the BofA note.

On the other hand, Airtel will be launching 5G Non-Standalone (NSA) and would then need to make an additional spend to modernize the network to meet the quality offered by Jio’s network.

2. Investment of INR 3000 billion ($38.18 billion) for 5G?

Buoyed by a better-than-expected response to the 5G spectrum auction, the Indian government believes that the sector will witness an investment of $38.18 billion in 4G and 5G over the next two to three years.

The government was expecting to acquire funds worth $14 billion but the auction has resulted in generating almost $19 billion for the government. This auction has witnessed the maximum spending by the industry to acquire airwaves.

At the same time, the debt of the industry is likely to increase because of the auction spending and the subsequent launch of services later this year. There is then a possibility of the telcos going for a rate hike before the launch of 5G to make up for the damage.

3. 5G launch

Bharti Airtel is planning to launch 5G in a few cities initially before expanding it to the entire country. On the other hand, Vodafone Idea has acquired spectrum in 17 circles in the 3300 MHz frequency band and in 16 circles in the 26 GHz band.

Traditionally, Indian telcos have not been able to charge a premium for new technology, be it 3G or 4G. Analysts believe that this may change with 5G. “With potentially higher speed on offer and likely initial uptake from premium customers (smartphones above INR 15k), there is a potential for telcos to charge a premium for 5G (vs 4G), in our view. 5G tariff plans would be a key monitorable in the near term, and 5G premium (vs 4G) may provide the next leg of ARPU uptick for the telcos,” says the Nomura note.