- It’s always important in business (and perhaps life in general) to not put all one’s eggs in one basket

- The fiber industry was really jazzed about the opportunities from BEAD

- But now that many of those opportunities may shift to satellite, fiber players are shifting focus to AI

Perhaps it’s a sign of the times in the fiber industry, which has taken a big blow because of revisions to the Broadband Equity, Access and Deployment (BEAD) program, but the Fiber Broadband Association’s latest webinar focused on the opportunities that fiber players have to connect AI data centers.

Webinar moderator David Norris kicked off the discussion, saying, “Today we're going to be talking about how we solve the unappreciated fiber capacity increase needed between AI data centers.”

Speaking on the FBA webinar, Michael Render, CEO of RVA Market Research and Consulting, said everyone has heard about the major challenges to building new AI data centers, including the procurement of land, energy, water and semiconductors. “All these things are potential constraints to meeting this dream of AI that is out there,” said Render. “But one that is not discussed near enough is the fiber infrastructure.”

It should be noted that Fierce Network has been writing quite a lot about the opportunities for fiber players to connect AI data centers.

Render said many of the newer data centers “are going to be out in the middle of nowhere,” and yet they must be connected with fiber. “So, we've got to create new laterals from those to the nearest internet connection point in different directions, if possible. And so, each one of those we're looking at 35 to 50 miles on average.”

RVA recently penned a white paper in conjunction with FBA, and the paper notes that large data center operators want redundant routes for maximum security, and they want these routes to head in three or four different directions from the data center. They also want the connections to come from at least two different fiber providers.

In addition to a lot more fiber connections between data centers, there will also be a need for more capacity on existing long-haul routes.

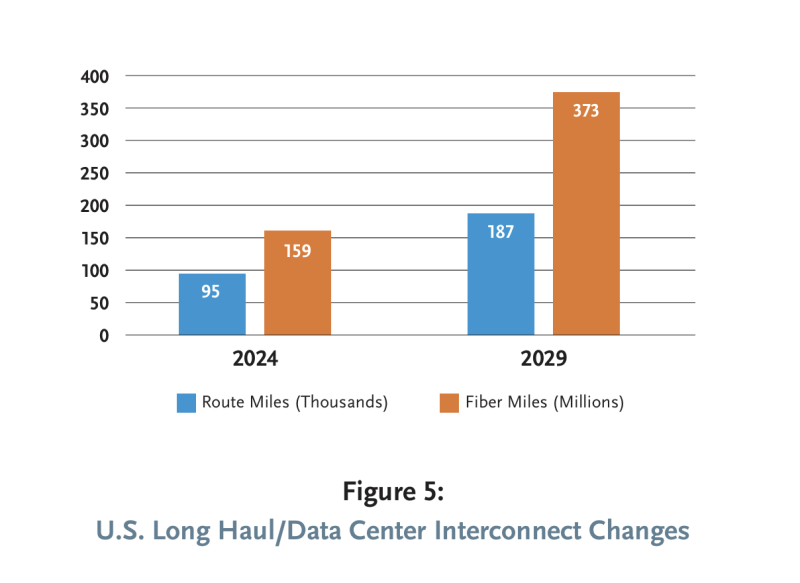

RVA estimates there are currently a total of 95,000 unique long-haul route miles and 159 million long-haul fiber miles (miles including multiple strands of fiber) in the U.S.

But with the demand coming from AI, RVA estimates that route miles will need to double over the next five years to 187,000, and fiber miles will need to increase 2.3x to 373 million miles by 2029.

Many types of companies are building this infrastructure, including large providers such as Lumen, AT&T and Verizon. But even Tier 3 telecoms are sometimes being called upon in part because of their detailed knowledge of local power availability, easements and land ownership.

Speaking on the FBA webinar, David Eckard, VP of Broadband Partners with Nokia, said the demand for more and faster broadband for data centers is “evolving at speeds that are almost breakneck.” He added, “It's just insatiable amounts of demand from many of these hyperscalers who are actually building these AI centers.”

And that’s certainly good news for the fiber broadband industry, coming at a good time considering the disappointment of BEAD.