- AT&T, T-Mobile and Verizon collectively want to deploy fiber to about 119M U.S. locations

- Each operator is progressing differently with fiber, but AT&T is most ahead so far

- Here’s what they said in their Q2 earnings calls about fiber strategy

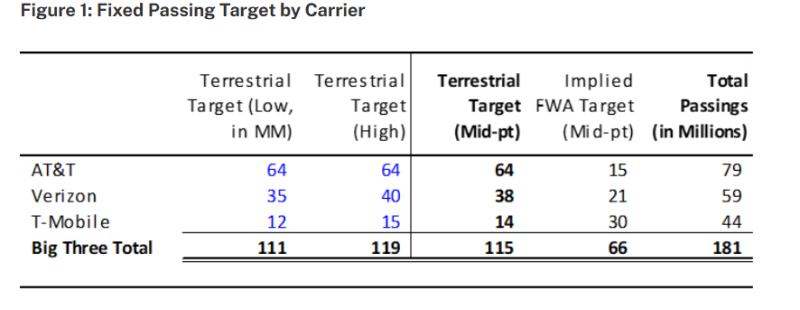

Second quarter results are in and a fiber frenzy is in the air among the big 3 U.S. mobile operators. Passings-wise, AT&T, T-Mobile and Verizon are collectively targeting about 119 million fiber locations in the coming years, per New Street Research.

It goes without saying all three companies are looking to roll out more fiber wherever they can, but they are at slightly different places in their deployment strategies. To unpack what's really going on, we checked out what operators said about fiber in their latest earnings calls.

AT&T

In terms of current fiber footprint scope, it’s safe to say AT&T has its competitors beat.

Now that it has over 30 million fiber locations under its belt, AT&T is looking to reach over 60 million fiber passings by 2030 with the help of Lumen’s fiber-to-the-home biz, the Gigapower joint venture and “agreements with other commercial open access providers,” said CEO John Stankey.

Despite mentioning Gigapower, he surprisingly didn’t delve deeper into how the JV is progressing and where it expects to pick up more open access opportunity.

“We suspect that Gigapower has fallen short of expectations so far,” said NSR analyst Jonathan Chaplin in a note to investors. “As far as we have seen, the company still isn’t disclosing Gigapower locations, which means they are still too small to matter after over two years of being in business.”

AT&T’s earnings call also saw no shortage of praise for President Trump’s “One Big Beautiful Bill Act.”

Stankey, who claimed the legislation is “more significant” than the Telecommunications Act of 1996, stated the tax provisions will enable AT&T to increase its deployment pace to about 4 million per year, “a run rate we expect to achieve by the end of 2026.”

Verizon

With FCC approval for its $20 billion Frontier acquisition in hand, Verizon is optimistic it can close the deal by early 2026 even as it navigates through state regulations.

The operator thus far got the green light from eight states, said CFO Anthony Skiadas, and is “productively engaged with the remaining state regulatory agencies.”

In light of Verizon ending its diversity, equity and inclusion (DEI) programs to get across the FCC finish line, California is probing the merger and asking Verizon how it plans to comply with the state's own DEI laws.

Once Frontier's closed, Verizon plans to reach somewhere around 35-40 million locations in the coming years. This year it's on track to pass 650,000 locations with fiber and it previously stated plans to build 1 million passings annually after the deal's done.

Unlike AT&T, Verizon did not issue an updated fiber target post-OBBB. However, CEO Hans Vestberg on the call mentioned “the tax reform is helping us to get faster to the priorities we have.”

In New Street’s view, Verizon needs to pick up the pace before other providers swoop in on its territory.

Given the company’s current deployment speed, “it would take them eight years to get to the low end of their 35-40MM target,” stated Chaplin. “Others will get to many of the attractive locations before Verizon does.”

T-Mobile

When it comes to fiber, T-Mobile is “off to the races,” according to CEO Mike Sievert. The Lumos and Metronet acquisitions are officially done deals, as the company targets at least 100,000 fiber net additions this year.

The 100,000 net adds will come from both joint ventures as well as wholesale markets, said Mike Katz, T-Mobile’s president of marketing, strategy and products. In addition to acquisitions, T-Mobile has been working with open access network operators like Intrepid and Tillman to expand its footprint.

And T-Mobile is far from done in beefing up its fiber M&A portfolio, execs indicated on the Q2 call.

“We're very open to looking at investments in fiber,” said T-Mobile COO Srini Gopalan. “They need to be the right investments, and we are – and I think we've showed our hand on this – we like pure play fiber assets.”

The carrier is targeting 12-15 million fiber locations through Lumos, Metronet and open access partnerships. Assuming T-Mobile gets around 40% broadband penetration via its fixed wireless access (FWA) customer base, that amounts to another 30 million homes passed, Gopalan added.

“So we're becoming the equivalent of 40 million to 45 million homes passed as a broadband player, and that's before we go make other investments,” he added.

Even if T-Mobile chases further fiber deals, it still has its work cut out to catch up with AT&T and Verizon on fixed broadband passings, according to New Street.

“The only sizable asset” T-Mobile could acquire next is Google Fiber with 2.3 million locations, said NSR analysts. However, “this won’t do much to narrow the gap with competitors. Everything else is much smaller.”