- CommScope is selling its largest business unit to help pay off its debt

- Wall Street is happy with the news, causing the company's stock to rise sharply

- After the sale to Amphenol, CommScope will focus on its Ruckus and Access Network Solutions businesses

CommScope today announced it is selling its Connectivity and Cable Solutions (CCS) business to Amphenol Corporation for approximately $10.5 billion in cash. CCS is CommScope’s largest business segment, by far. But one industry analyst says this sale is actually a good thing, indicating healthiness in the telecommunications broadband industry.

Dell’Oro Group analyst Jeff Heynen told Fierce that the sale of the CCS business is “mostly just CommScope figuring out how to manage its debt load.” But he doesn’t see the sale as a bad sign for the broadband industry. In fact he said it’s a good sign. “There’s demand in the market for additional fiber not only for ISPs and broadband but for data center interconnects,” said Heynen. “I think the CCS division has tremendous value at this point in time. It's a definite positive for the industry and also a positive for CommScope."

In fact, CommScope’s stock (NASDAQ:COMM) has risen about 70% today to $14.32 per share as of press time.

The CCS business generated about $2.8 billion in net sales in 2024, driven by data center demand to support generative AI (GenAI) buildouts. The company’s other two business segments are its Networking, Intelligent Cellular & Security Solutions (NICS), which generated $1.05 billion in net sales in 2024 and its Access Network Solutions (ANS) business, which garnered about $360 million in net sales in 2024.

CommScope plagued by debt

But the company has been plagued by debt, and in January 2025, CommScope completed the sale of its outdoor wireless network (OWN) segment and its distributed antenna systems (DAS) business to Amphenol, which also paid cash for those businesses.

After those divestitures, Ruckus has become the primary remaining business under NICS, and in fact, the company is changing the name of the business unit from “NICS” to “Ruckus.”

During its Q1 earnings call in May, CommScope CEO Chuck Treadway warned that the company would likely see an estimated $10 million to $15 million “growth impact” from tariffs in Q2. He said the tariffs would mostly affect the Ruckus business.

But that hasn’t come to pass – at least not yet – as many tariffs have been put on pause.

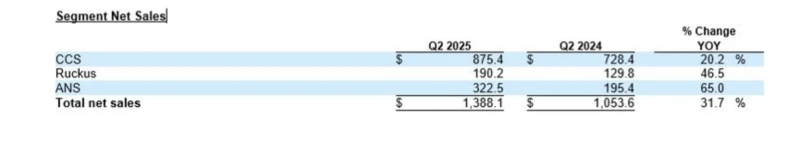

CommScope will hold its Q2 2025 earnings call with analysts later today. But it’s already reported that its Q2 net sales were $1.39 billion, improving year-over-year in each of the three business segments.

Analysts will undoubtedly have questions on the earnings call today about the sale of the CCS business.

The sale is expected to close within the first half of 2026, subject to customary closing conditions, including receipt of applicable regulatory approvals and the affirmative vote of the shareholders. The vote is required under Delaware law due to the nature and size of the transaction.

CommScope expects net proceeds after taxes and transaction expenses to be about $10 billion. After repaying all debt, redeeming all preferred equity, which is held by global investment firm Carlyle and adding modest leverage on the remaining business, the company will have significant excess cash, which it plans to distribute to shareholders as a dividend within 60 to 90 days following the closing of the proposed transaction.

In the announcement today Treadway said, “In our ANS and Ruckus businesses, we will continue to develop the next generation of network connectivity.”

Who is Amphenol?

Amphenol is a large manufacturer of interconnect products with annual revenues of about $13.6 billion. It’s headquartered in Wallingford, Connecticut and has manufacturing facilities in more than 30 countries. It employs about 95,000 people.

The company makes fiber optic connectors, cables and cable assemblies, antenna systems and other interconnection technologies for the wireless and broadband industries in addition to products for other industry verticals.