- Many states still prefer fiber for BEAD deployments but some see waning wireline interest

- Louisiana and Virginia however plan to award over 80% of funds to fiber

- A study shows eligible BEAD locations have declined 65% in the last three years

Fiber still seems to be the gameplan for states re-evaluating their buildout strategies for the Broadband Equity, Access and Deployment (BEAD) program. But initial bidding results are a mixed bag as fewer eligible locations are on the table.

Louisiana and Virginia unveiled revised final proposals reflecting the results of the “Benefit of the Bargain” round, where NTIA required states to conduct an additional bidding round to ensure the lowest-cost broadband option. Nevertheless, the duo indicated the bulk of their BEAD funds will still go to fiber providers.

Virginia noted 81% of its roughly 130,000 BEAD eligible locations will be served by fiber, 10% will be covered by low-earth orbit (LEO) satellite while cable and fixed wireless access (FWA) providers will serve the remaining locations.

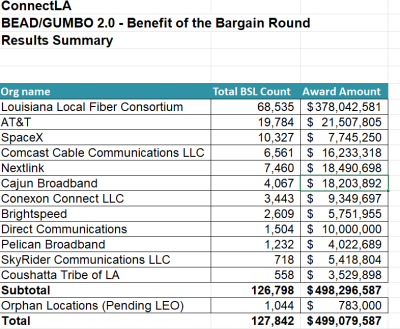

Louisiana is in a similar boat, as it plans to bring fiber to 80% of approximately 127,000 broadband-serviceable BEAD locations. That’s only slightly down from the state’s initial goal of covering 95% of areas with fiber. SpaceX’s Starlink notably scored $7.7 million for over 10,000 locations but received less funding than wireline providers like AT&T and Comcast.

Though the program’s fiber preference is no more, the new BEAD rules hone in on the term “priority broadband project,” which may give states some wiggle room to decide whether a technology can scale over time to meet growing connectivity needs.

How NTIA will evaluate Louisiana and Virginia’s proposals remains to be seen, but the results “[provide] comfort” to other states seeking to dole out most of their BEAD funds to wireline providers, said New Street Research Policy Analyst Blair Levin.

“In this highly polarized environment, the fact that both states are led by Republican governors sends a signal to other states that it is acceptable for Republicans to still fund fiber, which nearly all states prefer,” he wrote in a note this week.

But not all states are being met with the same enthusiasm from ISPs. Jade Piros de Carvalho, former VP of broadband advocacy and partnerships at Bonfire, said several state broadband offices are reporting a “more anemic response” from wireline providers that aren’t interested in a “race to the bottom on cost” against satellite.

Some BEAD locations may be left without a provider altogether. In Minnesota, 22,000 of 76,000 eligible locations didn’t get a first-round bid, said state broadband chief Bree Maki at Mountain Connect last week.

Not all states are discouraged by the BEAD changes. New Mexico, which has advocated for more subsidized satellite deployments, said it received 42 new applications in just two weeks. Arizona similarly noted a 33% increase in applicants, with every location in the state getting at least one bid.

Slim pickings for BEAD fiber

Another challenge staring down wireline ISPs is that overall pickings for BEAD have slimmed since NTIA first allocated funds. The Advanced Communications Law and Policy Institute (ACLP) estimates approximately 4.2 million unserved and underserved locations are currently BEAD-eligible – down 65% from roughly 12 million in 2022.

This partly stems from more satellite and unlicensed fixed wireless access entering the fray. A Nebraska official noted the program’s changes have disqualified more than half of nearly 30,000 underserved locations, meaning the state will likely spend only half of its $405 million BEAD allocation.

BEAD delays also haven’t stopped operators in their quest to roll out more fiber wherever they can – with or without government funding. U.S. fiber providers are set to reach 139 million total passings by 2030, according to NSR.

FWA in ‘no-man’s land’ for BEAD

FWA meanwhile isn’t seeing the same BEAD gains as fiber and satellite. Virginia’s proposal indicated it plans to dole out just 1% of its allocation to FWA providers. Louisiana awarded funds to some ISPs that provide FWA, like Cajun Broadband and Nextlink, but these companies also offer fiber.

According to Levin, fixed wireless “appears to be stranded in the no-man's-land middle” between low-cost LEO and states continuing to prioritize fiber.

But the revived BEAD process is still in its early innings, as the remaining states and territories have until September 4 to turn in their updated proposals.

“We continue to believe wireless interests will likely see somewhat higher awards but probably not the huge increase that their complaints about the unfair Biden fiber preference over the last three years were targeting to achieve,” Levin concluded.