- https://www.fierce-network.com/5g/standalone-5g-summer-wheres-t-mobile-5g-sa5G SA deployments are getting easier, analysts note

- Cloud-native maturity and AI demand are driving adoption

- AT&T’s CTO said that “millions” of subscribers are already on its 5G SA network

Standalone 5G is in the air this summer, with operators in Europe, Japan, Latin America, the United Kingdom and the United States lighting up pure 5G SA cores. AT&T’s CTO Jeremy Legg said this week at the Keybanc conference that his company already has “millions” of subscribers on its 5G SA network, meaning AT&T has now rolled well past this “5G SA-ready” category they had been classed in.

But why now? What makes 2025 the summer of standalone?

One factor is that making the switch is easier today than it has been.

“Cloud native architecture and 5G core networks have matured, making the deployments easier than they were a few years ago,” Recon Analytics analyst Daryl Schoolar said. “For a new 5G deployment, it is much easier to go SA from the start than it was earlier in the 2020s. Also, for those who started on NSA, moving to SA is easier now as well.”

Indeed, a consumer today just needs to have a device that supports a 5G SA network, such as the latest Apple iPhone or Google Android smartphone, to switch the standalone settings on. Delivering network slicing or SA IoT devices to enterprises requires a little more effort.

T-Mobile well knows this, having turned on its nationwide 600 MHz low-band 5G SA network in August 2020. The operator moved to 5G SA on its 2.4 GHz mid-band network in November 2022, and launched its first network slices in August 2023.

Money is another motivating factor. Operators want to monetize their network investments beyond just offering Fixed Wireless Access (FWA) services, and this requires the SA core to offer network slicing or Reduced Capability (RedCap) IoT services, Schoolar noted.

For example, AT&T deployed its nationwide 5G SA network to roll out its nationwide RedCap service, while Verizon has been able to offer a nationwide priority slice for first responders because it has switched on its 5G SA across the U.S.

“Future network evolutions to 5G-Advanced and 6G will require the SA architecture, which is a motivating factor here as well,” Schoolar said. Even if a mobile operator does not have a specific service in mind, it will still need an SA core once it works out its monetization plans, the analyst noted.

And, of course, we couldn't get through a story without mentioning AI.

AI is one of the drivers for 5G SA expansion, Ericsson noted.

“Penetration of 5G standalone is still limited but is needed to fully support AI use cases at the edge, requiring ultra-low latency and enhanced uplink,” a spokesperson told us. Ericsson has recently worked with SoftBank in Japan on enhancing its 4G and 5G networks, with a focus on standalone. Nokia, meanwhile, is working with Cisco and F5 on Rakuten Mobile's 5G SA deployment.

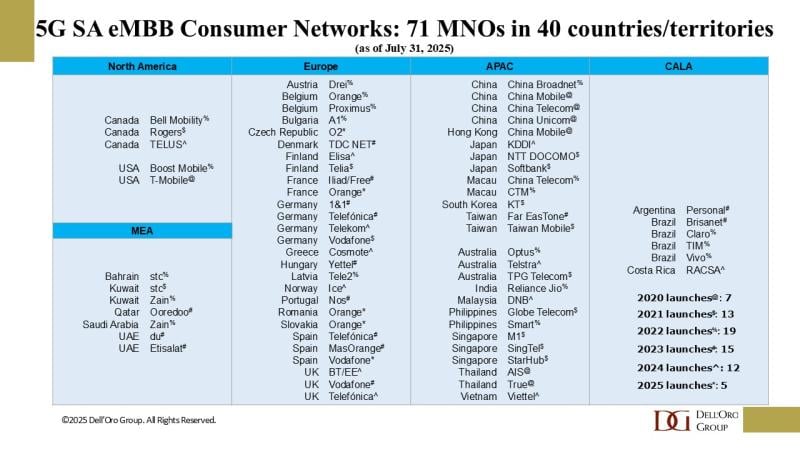

Contributing growth factors for 5G Standalone investments include transitioning more consumers to 5G SA subscription plans and expanding coverage to more of the population in smaller cities and rural areas, Dave Bolan, a research director at Dell’Oro Group, said.

“It is difficult to say when all of these scenarios will materialize", Bolan said noting that macro-economic factors, the availability of Capex funds, multiple Cloud deployment options including Telco Cloud, Public Cloud and Hybrid Cloud, as well as the potential impact of AI in network operations could all come into play in influencing the timing of 5G SA deployments.

But regardless of the driver, the deployment uptick is a boon for vendors that have been struggling with flagging mobile growth.

“In the short term, we see the impact of additional investments in 5G standalone networks, which is certainly welcomed by the vendors supplying 5G SA technology to the mobile network operators,” Bolan said.