- Tarana thinks its new G2 platform can help expand fixed wireless access in big cities

- Urban FWA usage has gone up, but capacity issues are still prevalent

- Tarana’s tech also supports four-carrier integration across licensed and unlicensed spectrum, said CEO Basil Alwan

Tarana originally made a name for itself deploying fixed wireless access (FWA) in the rural U.S. Now, the company sees potential for the technology to reach new heights in more urban environments.

The company recently launched G2, the next iteration of its FWA platform that offers 6.4 Gbps per sector (that is, the coverage area served by a base station). The increased capacity allows operators to deliver fixed wireless to approximately 2,000 customers per tower, a ratio Tarana CEO Basil Alwan said is ideal for larger ISPs.

Tarana currently has around 300 operator customers, ranging from regional providers such as Nextlink and Watch Communications to the big names like Cox and USCellular.

“But there’s much bigger companies that are coming along and G2 is what they want,” Alwan told Fierce. “They want to go after it in the middle of towns, they want to go after Phoenix…we have one company building in San Jose.”

FWA usage in metro areas has been steadily climbing in the last few years. An Opensignal report from June 2024 said FWA providers so far have claimed around 6% of urban market share, and a study from WIA estimated FWA has an addressable urban market of 14.6 million households.

But according to Alwan, traditional 5G and Wi-Fi based FWA networks each have their issues when it comes to expanding to denser markets.

“If you talk to the WISPs that have done the rural wireless with Wi-Fi stuff, they’ll tell you they never really went into town because they could never get enough density to justify it,” he said. “If you put up an access point and you have 10 homes on it, those access points start to self-interfere at 10, 15, 20 points.”

5G FWA providers, namely the big 3 mobile network operators (MNOs), have gotten further along in urban penetration by deploying technologies like millimeter wave and standalone (SA) 5G. But the problem is carriers are running out of spectrum that they can allocate specifically to FWA, Alwan noted.

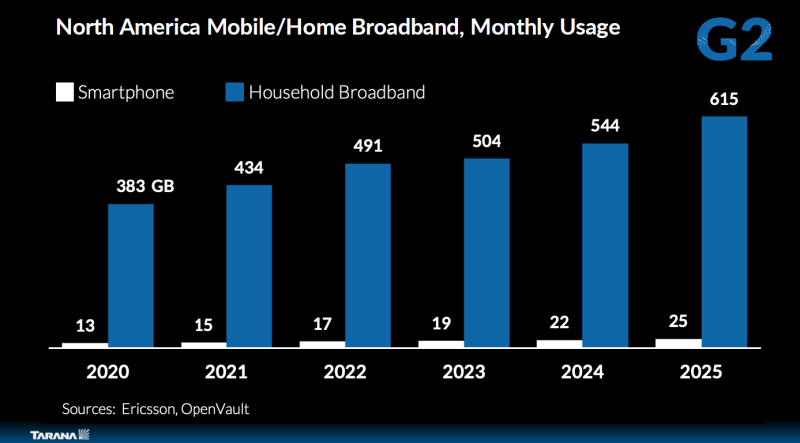

“It’s 30 times more bandwidth intensive to serve a home than it is to serve a mobile [device],” he said, citing data on North American monthly usage trends from Ericsson and OpenVault. “If you build a mobile network and start putting homes on it, it quickly consumes all your spectrum and bandwidth.”

Tarana’s spectrum specs

Tarana’s FWA technology uses a combination of unlicensed 5GHz and 6GHz spectrum as well as the licensed Citizen Broadband Radio Services (CBRS) band. Alwan said another key upgrade in G2 is that it supports four-carrier integration across both licensed and unlicensed spectrum, giving operators access to 160MHz across multiple bands in a single radio.

He explained Tarana can do that with its dual-resonant antennas, which are designed to work at two different operating frequencies at the same time. “This gives customers the ability to have a couple of carriers in CBRS, a couple of carriers in 6GHz” to deliver 1.6 Gbps per link, which Alwan noted was a step up from G1’s 800 Mbps threshold.

In short, Tarana is aiming to give operators more options to carry traffic since they won’t always have access to the same spectrum across their footprints.

“One way to think about it is you’re trying to get from one city to the next, you got four highways to do it,” Alwan said. “Four routes, four different frequencies and how fast you can go in each route.”

The wireless landscape has become even more complicated now that EchoStar is selling off huge chunks of its spectrum to AT&T and SpaceX. The carve-out has left the industry wondering who could grab the rest of EchoStar’s leftovers.

In Alwan’s view, EchoStar’s remaining Priority Access Licenses (PALs) within the CBRS band “are extremely good for our product.” Owners of PALs have higher priority than General Authorized Access (GAA) users, who can only tap into CBRS when it’s not being used by incumbents and PAL users.

“It’s a great opportunity for anyone in fixed wireless,” Alwan noted. “Those things being up for grabs, or whether Dish decides to do something with them, it’s amazing.”