- Hyperscalers had an order backlog of well over $800 million as of June 30.

- Colocation providers are also feeling pressure from skyrocketing AI demand.

- But it takes time to build new capacity, which means there's little short-term relief in sight.

There’s more to the AI bubble than outrageous valuations for companies that have yet to deliver any real product. It actually also encompasses huge investments hyperscalers are making to meet a wave of AI-associated demand. And it’s hard to say how much of that hunger might dissipate if AI fails to deliver on its promises.

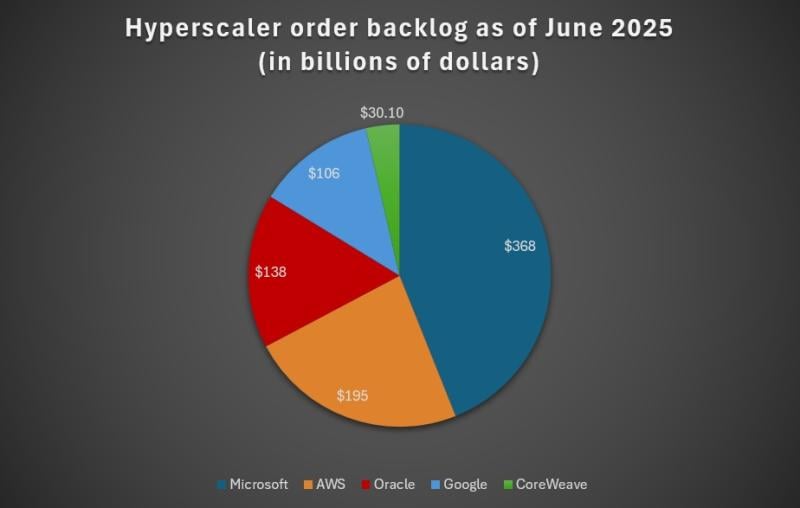

As of the end of June, the big three hyperscalers plus Oracle and CoreWeave had a collective order backlog approaching the $1 trillion mark.

Microsoft had the largest tally of performance obligations, at $368 billion, followed by AWS ($195 billion) and Oracle ($138 billion). Google contributed another $106 billion and CoreWeave $30.1 billion for a total of $837.1 billion.

Hyperscalers are pumping tens of billions of dollars into standing up new data center facilities to fulfill these orders. But they’re not the only ones feeling the crunch.

Jones Lang LaSalle (JLL), a real estate and investment management company, noted in a new report that vacancy rates at colocation facilities in North America were at a record low of 2.3% as of mid-2025.

"Even if preleasing activity slows significantly in the near-term, vacancy would likely remain below 5% through 2027. A more likely scenario is that vacancy holds in the 2% range through 2027," JLL Senior Director for Americas Data Center Research and Strategy Andrew Baston wrote.

At least 8 gigawatts of new capacity is under construction – with 73% of that already preleased, Baston noted in the report. Another 31.6 GW of capacity is in the planning stages.

But data centers aren’t built in a day, which means there’s little relief in sight. The report highlighted that the average wait time for a connection to the power grid has reached four years, significantly slowing progress getting new capacity online.

"Companies looking to expand their data center operations may be limited to preleasing in new developments. This could require a year or more of waiting for construction to be completed before tenants can take occupancy," Baston noted.

In an earlier report, JLL indicated that AI represented about 15% of data center workloads in 2024, with that figure expected to increase to 40% by 2030 assuming all goes to plan.

Let’s hope the enthusiasm driving this demand lasts that long.