- Investment management firms are executing a de facto takeover of U.S. critical digital infrastructure

- BlackRock, Blackstone, and KKR are racing to build power-hungry AI factories and data centers, further exacerbating America’s utility shortfall

- These ethically challenged firms dominate an emerging AI-infrastructure economy where the U.S. government is largely absent

Private capital is pouring hundreds of billions of dollars into building digital infrastructure in the U.S. Historically, the government was responsible for this, but back in the 1970s, it abandoned its infrastructure mission. Today, lured by the AI boom, private capital is stepping in to fill the void with a vengeance.

This is not good news.

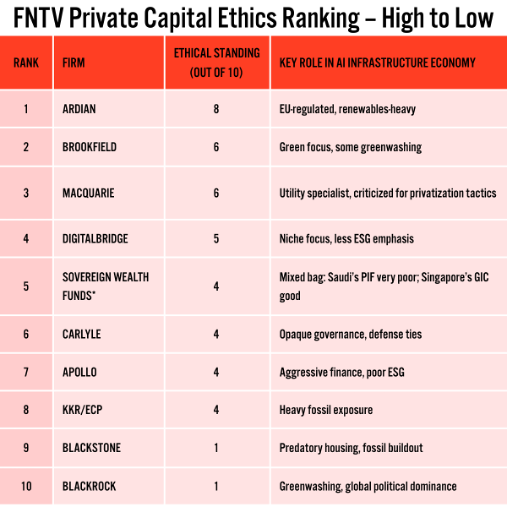

The most powerful players — BlackRock, Blackstone and the KKR/ECP partnership — control vast pools of capital and the most significant projects, with trillions of dollars in assets under management and $50-$100 billion funds (see table below). These 10 firms now decide where, how quickly and on what terms AI infrastructure gets built. It’s all in stark contrast to the New Deal era, when Roosevelt’s government used citizen debt to fund infrastructure projects that revitalized the economy and secured America’s global prominence.

Source: FNTV, Saunders, Deep Research/OpenAI

But if the infrastructure for the next digital industrial revolution is being built, does it really matter who builds it? Yes, because these investment management firms operate for their own profit, not for the public good. They invest in “scalable digital” infrastructure where they see the highest returns and least friction — rather than in the chronically inadequate U.S. water and electrical utilities that have longer life cycles, lower margins and are burdened with endless regulation.

This leaves North America short on the utilities needed to cool and power new AI data centers, some of which consume as much energy as a small city. (OECD numbers show that only about 2% of private infrastructure investment goes to water projects).

It’s a paradoxical situation: by pouring hundreds of billions into AI data centers across the U.S. — each demanding enormous amounts of energy — while neglecting utility infrastructure, these firms are creating a negative feedback loop that threatens America’s global competitiveness. Currently, the U.S. ranks a disappointing 13th in FNTV’s Top 25 Global AI Infrastructure Index, and the activities of these firms could cause this position to decline further.

It’s already too late for the U.S. administration to solve this by mandating that hyperscalers help fund utility expansion, or by offering low-interest government loan guarantees—utilities take a decade to develop, while data centers can be constructed in two years. The timelines are fundamentally misaligned.

As a result, the AI boom is on a collision course with physical infrastructure realities. In the next 10 years, grid and water constraints will impose a hard ceiling on AI’s growth in the U.S. The country’s best hope is a wildly improbable long shot: a scientific breakthrough like nuclear fission or the development of ultra-efficient, cost-effective photovoltaic materials such as perovskite solar cells.

Another possibility is water tokenization — using blockchain-based digital tokens to represent ownership, rights or access to water resources. While this could incentivize private capital to invest in water utilities, it risks reducing water’s status as a human right. Numerous countries and startups are exploring water tokens as a way to improve distribution efficiency. But combined with greed, deregulated tech markets, and the potential for water commodification, water tokenization could tip America into full for-profit dystopia.

Ethically challenged

Beyond technology and timing, the core issue with the emerging AI-infrastructure economy is that the most successful firms — in terms of capital, reach, and projects — are also the least ethical.

In a recent instance of leading by shameful example in the utility space, billionaire Stephen Schwarzman, the CEO of Blackstone, was caught filling the lake at his 2,500-acre country estate in Wiltshire with water tankers during a drought.

Smaller private capital players tend to perform better on ethical standards but lack influence over the future of AI infrastructure.

The table below ranks key infrastructure institutions out of 10 on four principles: transparency, environmental practices, social impact and governance and accountability. Notice how the standings are an inversion of the Power Top 10 list.

*Includes: Mubadala, PIF, GIC, Temasek

At the bottom of the ethics table, BlackRock, Blackstone and KKR/ECP possess the capital and connections to build whatever and wherever they want — and once it’s built, they can largely do whatever they want with it. Today in the U.S., there are no guardrails, leaving the engine room of the nation’s economic future in the hands of a private capital elite, while democracy sits this one out.

By allowing these gigantic, unprincipled investment firms to co-opt the national digital infrastructure strategy, the U.S. is rolling the dice. The companies that own the core infrastructure own the nation’s digital future. The question is not whether they will abuse their power but — based on their track record — why anyone would even think they wouldn’t.

Click here for more of this sort of thing.

Steve Saunders is a British-born communications analyst, investor and digital media entrepreneur with a career spanning decades.

Op-eds from industry experts, analysts or our editorial staff are opinion pieces that do not represent the opinions of Fierce Network.