-

Synergy Research Group said despite negative economic and optimization trends, cloud revenue jumped year on year in calendar Q3 2023

-

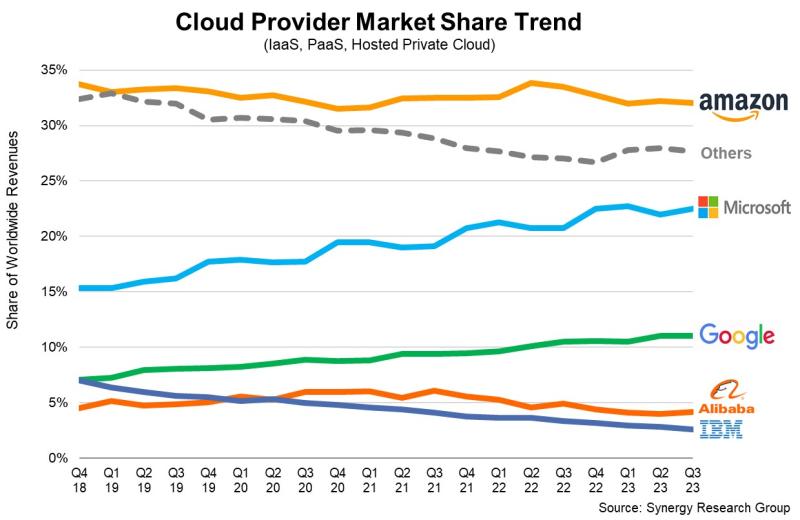

Hyperscaler market shares remained stable

-

AI is a huge growth driver and New Street Research weighed in on AWS' prospects in this realm

The earnings tallies are in and just as in every quarter, Synergy Research Group offered up a snapshot of what the cloud market as a whole looked like in calendar Q3 2023. The hyperscaler market shares were virtually unchanged, but needle that moved substantially was revenue.

According to Synergy, spending was up $10.5 billion year on year to a total of $68 billion.

As Synergy’s John Dinsdale explained, artificial intelligence (AI) was a key factor in optimization and economic trends. “The current economic and political climate has crimped some growth in cloud spending, but there is clear evidence that generative AI technology and services are starting to help overcome those barriers,” he wrote.

So, just who contributed what? Where the big three are concerned, Amazon Web Services (AWS) revenue came in at $23.1 billion; Microsoft’s Intelligent Cloud unit, which includes Azure, posted revenue of $24.3 billion; and Google Cloud revenue hit $8.4 billion.

In terms of market share, Dinsdale observed that Microsoft is now twice the size of Google Cloud, while AWS is nearly larger than the two combined. Specifically, AWS held a 32% market share in Q3 compared to Microsoft’s 23% and Google’s 11%. China’s Alibaba trailed with 4% market share while IBM and Salesforce hat 3% each and Oracle and Tencent had 2% each.

Looking ahead, Dinsdale said cloud provider investments in AI are already helping boost enterprise spending on cloud services, helping stabilize growth rates which have fallen over recent quarters.

New Street Research recently came to a similar conclusion about cloud growth rates bottoming out. And as to who has the lead on the AI front among the hyperscalers, New Street’s Dan Salmon had this to say in a Friday note to investors:

“The generative AI opportunity is only beginning to materialize, and while MSFT and Open AI may have the first mover momentum, we think AWS is only beginning to tap into its considerable opportunity, led by recent general availability of Bedrock, and strong interest in AMZN’s proprietary chips, Trainium and Inferentia.”

Do you have a cloud innovation that is alive and kicking? Submit for our Cloud Innovation Awards by November 3, 2023 here.