Service providers' ongoing movement to SDN and NFV, according to SNS Research, could grow at a CAGR of about 45% over the next three years.

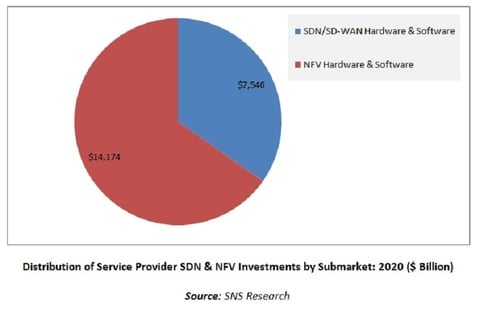

By the end of 2020, the research firm said in a new report that this growth will drive nearly $22 billion in SDN and NFV investments.

Besides addressing the ongoing capacity demand for mobile and wireline broadband services, the advent of SDN and NFV can reduce capex and opex burdens faced by service providers to handle emerging demands by reducing the reliance on proprietary hardware platforms.

AT&T, which has set a goal to virtualize 75% of its network by 2020, has already begun to see the benefits of migrating more of its network functions to SDN. As of the end of the quarter, 45% of AT&T's network functions were virtualized. AT&T is beginning to generate significant cost savings from its NFV/SDN initiatives.

The service provider noted during its third-quarter earnings call that it is generating significant cost savings from its NFV/SDN initiative.

Overall, service providers have already begun making significant investments in SDN and NFV across several use cases including but not limited to uCPE/vCPE, SD-WAN, Virtual Evolved Packet Core (vEPC), Virtualized Infrastructure Manager (vIMS), Cloud RAN and virtual content delivery networks (vCDN).