- The growth phase is over in the public telecom market

- Smartphones are saturated

- We will now see the industry consolidate at all levels - but there is a bright spot

I published an INSIGHT report six months ago, titled “The Business Shift to Commoditization." Based on indicators in the chip market, in the Open RAN software game, and the slowdown of mobile traffic growth, Mobile Experts' conclusion is that the growth phase is over in the public telecom market. Smartphones are saturated, and we will now see the industry consolidate at all levels.

That thesis is now playing out like a train wreck. You can see it in the news. AT&T has swallowed the Dish network…eliminating the one big Open RAN software opportunity. Vodafone will follow the same strategy as AT&T, with a dominant incumbent providing software and a collection of hardware vendors. Open RAN software vendors have fizzled, leaving Ericsson dominating the field. Intel is evaporating. Marvell is slowing down its support for mobile baseband.

We won’t see the same kind of consolidation that marked the 2G, 3G and 4G cycles — in those days, everyone saw the market as a growth business, and companies merged with an eye to the next big wave of deployment.

This time, big mergers between network vendors aren’t likely. There aren’t enough of them to consolidate much farther but we absolutely see consolidation at all levels anyway.

Here's what will happen

Operators will continue to merge, leaving one or two big players in many markets instead of three or four.

Some network vendors will pivot to other markets (watch Nokia pivot toward the data center and AI).

Telcos will rally around one major RAN software player and probably only one alternative.

Chip vendors will drop out, with R&D costs rising and a small RAN market becoming unattractive.

That’s what happens in the shift from growth market to commodity market — it’s a ruthless change in attitude as everybody focuses on operational efficiency instead of innovation.

Look on the bright side - FWA and D2D

Are you depressed reading this? Don’t be. New opportunities are emerging that are changing the game.

We can start by talking about fixed wireless access (FWA) and satellite direct-to-device (D2D) services, which together will add $100 billion in service revenue by 2030. That’s a significant growth opportunity outside of the traditional mobile market. As simple extensions of mobile broadband, with best-effort service, these will be incremental steps in revenue. But I think that D2D can lead to something bigger.

Clearly, selling connectivity for enterprise applications is not a commodity business. There’s a latent market that is waiting and asking for integrated solutions that bring connectivity, edge computing and AI inferences to the enterprise. Price is not a concern today; customers are wondering whether they can get the solution they want.

Companies like Nokia, Huawei and Celona have scratched the surface here and addressed some of the larger and more forward-thinking customers. There are thousands millions of additional customers out there that want private cellular but can’t find the right combination of network, compute, and software yet.

Watch out for the private cellular market

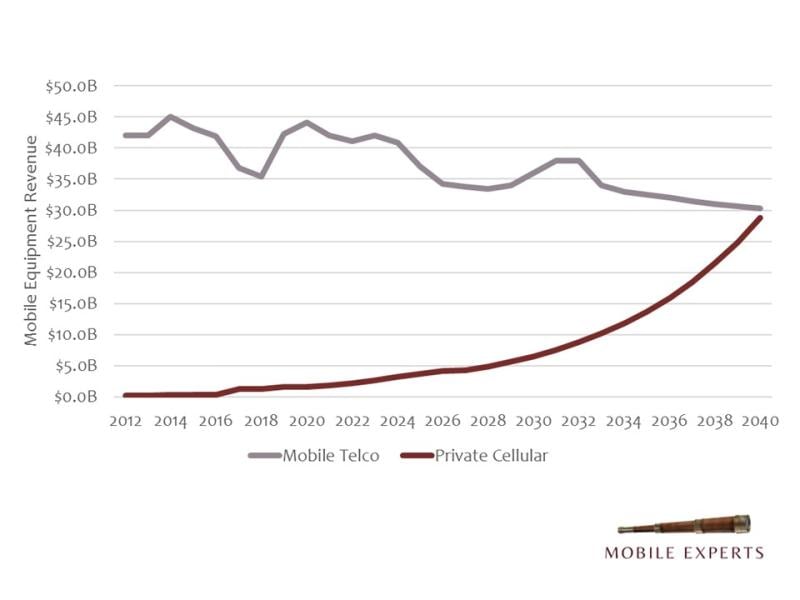

The private-cellular market is starting a 20-30 year growth cycle, with the potential to become as large as the mobile-broadband market was in its prime. Even better, it will be more diverse than the smartphone market ever was, with a far larger number of customers and a much more diverse range of applications.

Over the next few years, I expect the D2D market to orient itself around enterprise customers. Enterprise customers want guaranteed SLAs, and terrestrial networks have never been able to come through, whether they have network slicing software or not. With a multi-layered network that includes a satellite blanket, service providers will be able to actually guarantee reliable coverage at all times.

I think that’s a game-changer that will unlock hundreds of billions in premium revenue. More insights to come along these lines.

I say: Let the broadband business become a commodity — that’s natural and unavoidable. Focus on the enterprise opportunity and focus on premium revenue for better services. It may be at slower speeds. It may come with higher latency. Who cares? The revenue will be for reliability, not speed or latency.

Don’t waste your time whipping the dead horse. Mount up and ride a young colt.

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.

Op-eds from industry experts, analysts or our editorial staff are opinion pieces that do not represent the opinions of Fierce Network.