- Is “A Candle in the Wind” or "Highway to Hell” better for symbolizing wireless right now?

- UScellular was the largest mid-sized regional carrier in the U.S. with 4 million customers

- Now the spot goes to C-Spire and its approximately 1 million customers

T-Mobile wrapped up its $4.3 billion acquisition of UScellular last week and I’ve been ruminating over what song best represents the last years of UScellular’s life. Is it “A Candle in the Wind,” symbolizing a life that’s easily threatened and vulnerable to external forces, i.e., the Big 3 wireless carriers and cable companies?

Or is it more like “It’s the End of the World as We Know It”? After all, it is the end of an era in the U.S. wireless industry. With just over 4 million customers, UScellular was the largest mid-sized regional carrier. Now the title of fifth-largest U.S. facilities-based carrier goes to C-Spire, which near as I can tell, might have about 1 million customers.

Perhaps the occasion calls for something along the lines of “Highway to Hell,” signifying UScellular’s once defiant but eventual downward spiral that went nowhere fast. Their plan to focus on rural and less urban areas proved fatal as the Big 3 and cable companies encroached on their turf.

Whatever its swan song, the departure of UScellular (as we know it) comes at a weird time.

Consolidation: Come and gone

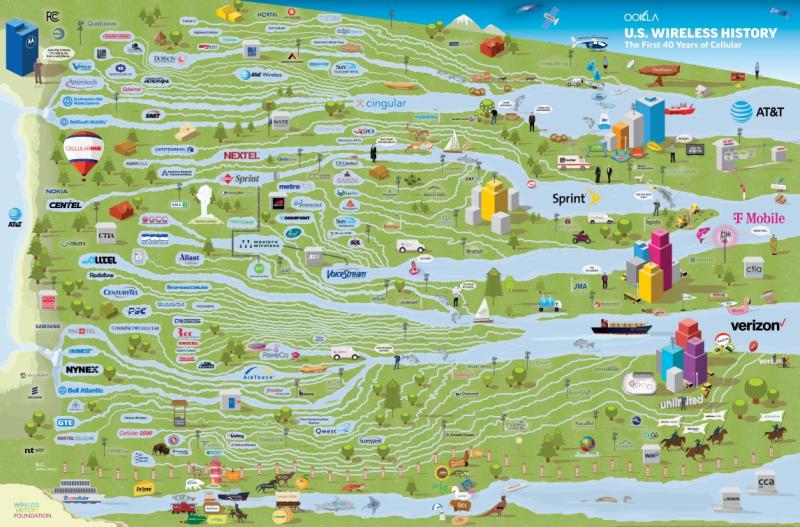

The Big 3’s domination in the U.S. market is in stark contrast to what the wireless industry looked like some 30 years ago when I first started covering wireless, which, by the way, was more than 10 years after UScellular was first established. One big disruptive force in the mid-1990s: the FCC’s auctions of PCS spectrum, which led to all kinds of new wireless licensees eager to challenge the established duopoly.

Talk about the Wild, Wild West in Wireless. The assumption was they wouldn’t all survive and spoiler alert: they didn’t. Consolidation crept up and eventually swept through the industry. Many smaller operators didn’t make it. Of course, a lot of their executives made out like bandits when they cashed out.

This graphic from Ookla paints a great picture of how the industry evolved.

Weird thing No. 1: FCC meddling with EchoStar

One thing that we didn’t have back in the old days, or really anytime in recent memory, was the sort of aggressive meddling that’s happening now at the FCC. Once considered an independent agency, the FCC is completely devoid of any sense of impartiality under the second Trump administration and agency Chairman Brendan Carr.

The most egregious way this is playing out is in the FCC’s requirement that companies dismantle their diversity, equity and inclusion (DEI) initiatives in order to get their transactions approved by the FCC. Never before was it the FCC’s job to tell companies who they can and cannot hire. This is government overreach at its worst.

But that’s not all. Carr appears hellbent on determining the winners and losers in American wireless businesses, market dynamics be damned. The most flagrant example of this is with EchoStar and its Dish Network and Boost Mobile brands. Recall that Carr sent a letter to EchoStar Chairman Charlie Ergen in May accusing EchoStar of warehousing spectrum and threatening to take it away, causing EchoStar to go into a tailspin and teeter on the brink of bankruptcy.

I get how the FCC needs to ensure that spectrum is put to its “highest and greatest use.” That’s nothing new. But here’s the thing. The industry for years accused Ergen of squatting on spectrum, and for good reason. He seemed to have an excuse at every turn.

Except in recent years, largely because the U.S. Department of Justice (DoJ) insisted upon it, EchoStar has been deploying network infrastructure to establish itself as a fourth facilities-based wireless operator. In other words, it’s actually using spectrum licenses that it accumulated over the years. That’s a good thing, right? Why mess with it?

Unfortunately, the company had to put the brakes on any further 5G network deployment because the FCC inquiries that Carr initiated triggered so much uncertainty around EchoStar’s 5G business. That’s a shame.

Weird thing No. 2: Disregard for No. 4

This isn’t the first time the industry has wrestled with the question of whether there should be three or four wireless carriers. That was a big question back in 2011 when AT&T tried to acquire T-Mobile. It came up again when T-Mobile was in the process of acquiring Sprint during the first Trump administration in 2019.

TL;DR: The Ajit Pai-led Republican FCC, which included Carr, signaled three was good enough, but the DoJ insisted that Dish be set up as a fourth national facilities-based competitor. That’s when Dish was given the task of building a 5G network from scratch. To help get established in wireless retail, it was agreed that Dish would buy Boost Mobile for $1.4 billion.

Dish built out its network over the ensuing years, and it now boasts a 5G Open RAN network that covers more than 80% of the population. To be sure, the Boost prepaid brand has struggled mightily under Dish, but in Q2 2025, it reported 212,000 net new phone customers, its third consecutive quarter of growth.

But apparently none of that matters because according to Carr, there is “no magic number” as to how many carriers the U.S. needs in order to have a competitive wireless industry. He’s fine with three. Go cable!

Now it looks like the DoJ’s anti-trust chief Gail Slater still cares about there being four viable facilities-based network providers in wireless, but the FCC does not. Weird. I never thought I’d say this, but we’ll see how this plays out with President Trump.

Weird thing No. 3: The D2D obsession

Everybody’s piling onto the next big shiny thing and today that’s the direct-to-device (D2D) market for satellite coverage direct to everyday smartphones. That includes the embattled EchoStar, which is now looking at D2D to save its soul.

Some of us have seen this movie before. Globalstar and Iridium can testify to how it was back in the Satellite 1.0 days. Both went through bankruptcies and lived to tell about it. Others, even Craig McCaw’s Microsoft-backed Teledesic, didn’t fare so well and ended up going belly up.

I get it. Space is cool. Satellites are exciting. But they’re still a very expensive business, even though SpaceX has done a lot to lower the costs of shooting the satellites into the sky. Not all of these companies that are gung-ho about D2D are going to make it to the other side, at least not in the D2D space. I sense some very bad sequels on the horizon.

I know. I’m dating myself. Perhaps the best way to conclude this is with the timeless “Follow the Yellow Brick Road.” That will at least get us to Oz, and who knows what’s in store for us there?

It can’t get any weirder than this.

Op-eds from industry experts, analysts or our editorial staff are opinion pieces that do not represent the opinions of Fierce Network.