- Open RAN holds great promise to diversify the RAN vendor ecosystem and reduce the reliance on vendors from China, Sweden and Finland

- There are now quite a lot of RAN vendors. But at the same time, Ericsson is dominating the RAN space more than ever

- Get the full story — download our free report for insights on whether open RAN will transform the wireless vendor landscape in the near future.

Open radio access networks (open RAN) became a tech darling during the first Trump administration, which touted it as the savior to U.S. telcos who would no longer need to use telecom equipment from China. But in the past couple of years, open RAN has struggled.

There are only a handful of wireless operators around the globe that are embracing open RAN. One of those operators is AT&T. On its face, it seems like a good thing that such a big operator is implementing open RAN. However, AT&T is working primarily with Ericsson, which some say defeats the whole purpose of introducing more RAN vendors into the competitive landscape.

From May 30 to July 26, 2025, Fierce Network Research conducted a survey of telecom operators to gauge the current status of open RAN, and we prepared a research report, disclosing and analyzing those findings, which you can download for free.

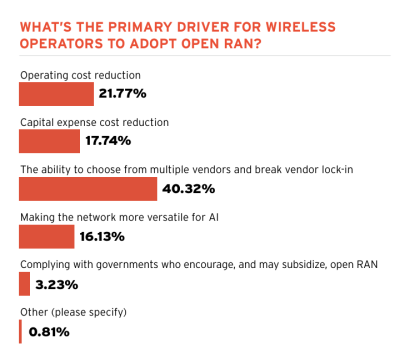

What's the open RAN top driver?

According to operators who took the Fierce Network Research survey, the top driver to adopt open RAN was having the ability to choose from multiple RAN vendors.

Roberto Yanez, who was with UScellular for 22 years until the recent purchase of the company by T-Mobile in August 2025, said having multiple vendors always helps operators to reduce costs. “In my experience, being able to have some leverage when you’re negotiating and having some competition in the industry is key to being able to achieve cost savings,” Yanez said. “We’ve seen from the large RAN vendors that the price gets really challenging.”

When asked how mature they think the current open RAN vendor ecosystem is, nearly half of survey respondents (45%) said it’s “early stage and needs more development.”

Despite being early stage, the open RAN ecosystem has quite a number of vendors.

John Baker, a familiar figure in the open RAN community, who worked for Mavenir for eight years, recently published an updated chart of all the open RAN vendors, which we included in our free report.

Fascinatingly, Baker’s list of open RAN vendors does not include Ericsson. Baker said he challenges the premise that Ericsson is a true open RAN vendor because it resists opening all of its interfaces to interoperate with other vendors.

AT&T’s choice of Ericsson

For its part, AT&T defends its choice to use Ericsson for its open RAN project. Rob Soni, VP of RAN technology at AT&T, told Fierce that it’s challenging to deploy open RAN in a brownfield network. “Moving forward with open, disaggregated, software-driven solutions requires transformation of vendor behavior, transformation of operator behavior and almost zero disruption or impact to customer services,” said Soni.

When it comes to responding to critics about using one major vendor for its open RAN deployment rather than diversifying the vendor landscape, Soni said, “Supporting O-RAN means supporting vendor competition, not particular competitors. The agreement with Ericsson creates a foundation that will enable us to deploy hardware and software components from alternative vendors as conditions warrant.”

Fierce Network Research’s analysis

AT&T’s point of view is understandable. It can’t afford to do anything so radical that it would jeopardize the function of its massive wireless network.

However, it is a great irony that Ericsson is the single largest vendor leading the open RAN charge. Ericsson is a public company that has a duty to maximize profits for its shareholders. Why should it work hard to introduce a lot more RAN competitors?

Download The status of open RAN in 2025 to read Fierce Network Research's full report and analysis.