- EchoStar isn’t the only wireless company in SpaceX’s crosshairs

- Globalstar, Ligado, Viasat and AST SpaceMobile are among the satellite companies targeted

- Much depends on Elon’s Musk relationship with President Trump

EchoStar has been in a fight for its life since the FCC threatened to take away spectrum licenses after Elon Musk’s SpaceX accused the company of barely using the 2 GHz/AWS-4 spectrum that it was allocated.

But EchoStar is just one of many satellite companies battling SpaceX over spectrum. In various proceedings at the FCC, SpaceX has clashed with Globalstar, Ligado and Viasat in addition to its well-publicized fight to get hold of EchoStar’s 2 GHz/AWS-4 spectrum.

One could argue SpaceX is going to war with the entire wireless industry in the upper C-band proceeding now unfolding at the FCC. The upper C-band spectrum, at 3.98-4.2 GHz, is right next to the 3.7 GHz C-band spectrum that Verizon and AT&T are rolling out for their 5G services.

The C-band auction drew a record $80 billion for the U.S. Treasury when it closed in 2021. A second C-band auction will likely trigger another round of high figures from the nation’s biggest wireless carriers.

SpaceX’s motives

Why is SpaceX so eager to get its hands on more spectrum? According to EchoStar, SpaceX already has access to about 25,500 megahertz of spectrum, without paying a single dime to the U.S. Treasury.

EchoStar believes SpaceX is on a mission to cripple EchoStar’s ability to offer a direct-to-device (D2D) service. That EchoStar service has barely gotten off the ground. That same reasoning could apply to pretty much every other D2D wannabee out there, regardless of how far along they are in their endeavors to provide satellite coverage to everyday, unmodified cell phones.

The exception is T-Mobile, the lone carrier that tied its D2D star to Starlink and its parent, SpaceX. T-Mobile agreed in 2022 to provide Starlink with a 5 megahertz section of G-block PSC 1.9 GHz spectrum for their D2D service, which started out with plain old texting and is expanding to applications like trail guides, weather updates, social media and more in October.

SpaceX didn’t respond to Fierce’s inquiries about its intentions for using spectrum currently held by other satellite communications companies or how much (if anything) it’s willing to pay for the spectrum.

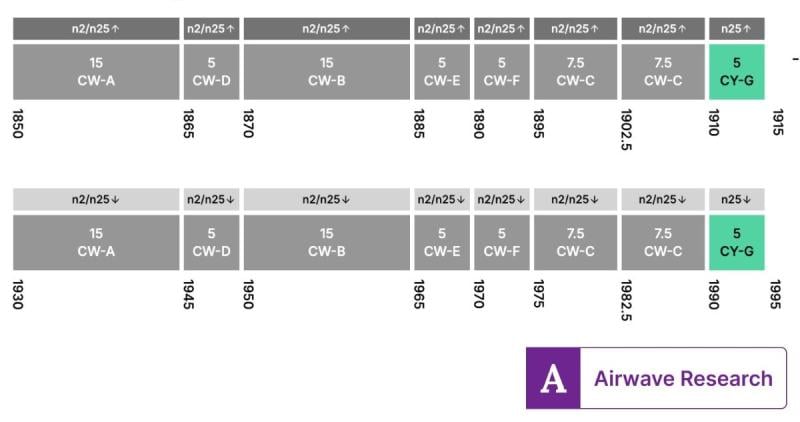

The piece of PCS spectrum that T-Mobile is lending to the Starlink D2D service is just a sliver of terrestrial spectrum.

Analysts say what Starlink/SpaceX really wants is mobile satellite service (MSS) spectrum, which EchoStar and other satellite companies currently control. The same motive applies to D2D rival AST SpaceMobile, which has deals with carriers including AT&T and Verizon for 850 MHz terrestrial spectrum. AST SpaceMobile is pursuing deals with Ligado and EllioSat for satellite-specific spectrum.

Satellite spectrum advantages include global harmonization, nationwide availability and cost, according to Tim Farrar, president of TMF Associates. Farrar’s firm and Summit Ridge Group President Armand Musey released a report in January that basically said MSS spectrum is preferable

“Everyone realizes that using terrestrial spectrum is very challenging because it's very valuable, particularly in urban areas, and so mobile operators don't want to give up very much of it. Going to MSS spectrum is a wise move,” Farrar told Fierce.

“It’s the optimal place for future deals because it’s not heavily used already and it’s not subject to some of the challenges, like interference from GPS,” he said. “That's what sort of hamstrung Ligado for years.”

CCS Insight analyst Luke Pearce echoed that sentiment, saying that for D2D, Starlink is seeking its own spectrum to avoid the technical and regulatory challenges of using mobile operators’ terrestrial bands, which can lead to interference and geographic limitations. In contrast, "dedicated satellite spectrum offers a tried-and-tested, reliable path for delivering consistent and wide-reaching service,” he said.

“It’s also plausible that Starlink’s push for spectrum access is partly strategic, aimed at preventing rivals from securing exclusive rights to key frequencies that could limit Starlink’s competitive position in satellite and direct-to-device services,” Pearce said.

In some ways, SpaceX’s land grab for spectrum is familiar. Other people’s spectrum “should be shared, but when it comes to [your] own spectrum, you have to put up a 10,000-foot wall,” quipped New Street Research policy analyst and a former FCC chief of staff Blair Levin.

“In a way, they’re no different than anyone else, but it is it the job of the FCC to figure out where the public interest is,” he told Fierce.

SpaceX’s standing since Musk/Trump fallout

Since Musk fell out of favor with President Trump in June, questions have swirled about how much clout Musk’s interests will continue to carry at the FCC, which is headed by Trump loyalist Chairman Brendan Carr.

So far, there’s been no evidence at the FCC or the Commerce Department that the falling out changed anything, Levin said.

Another question: Why does Carr seem to have it out for EchoStar? The company, founded by EchoStar Chairman Charlie Ergen, cited Carr’s regulatory inquiries as the reason it’s been unable to continue with its 5G network buildout, and its business outlook remains uncertain.

Farrar said it’s understandable that there's a sense of impatience about Ergen because he promised a lot of things over the years while his wireless network was slow to come to fruition relative to his access to spectrum.

“That's obvious,” Farrar said, and it contrasts with the speed at which SpaceX has moved to develop the Starlink system.

“That’s certainly notable, but at the end of the day, we'll have to see what [Carr] decides. And it's not just up to him. President Trump has encouraged them to reach a deal. It remains to be seen what that means for Chairman Carr’s decision,” Farrar said.