- The global network API market is taking longer than expected to materialize

- STL Partners slashed its 2030 revenue forecast by $3 billion

- Research Director Amy Cameron said operators are still building up the muscles needed for the new service

Mobile network APIs are still a work in progress — in fact, we declared them a “hot mess” as recently as 14 months ago. Turns out that hasn't really changed.

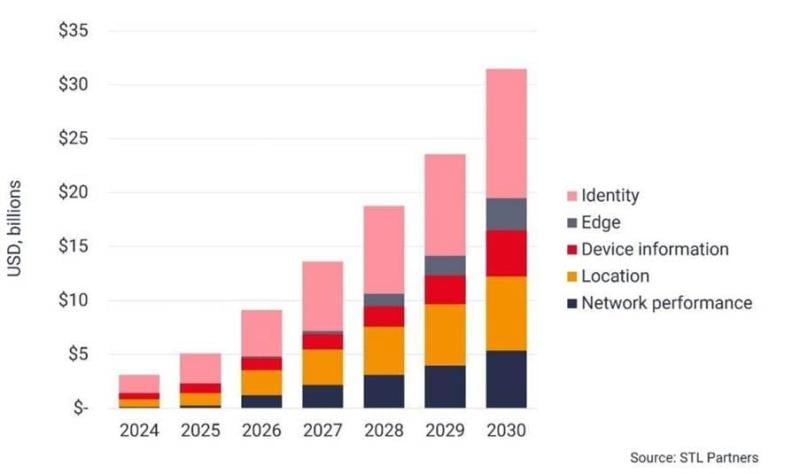

With the market slower to coalesce than originally anticipated, telecom research and consulting firm STL Partners has downgraded its short- and long-term projections from last year for the mobile global network API market. It is now forecasting the segment to reach $31 billion by 2030 versus an earlier projection of $34 billion.

In the nearer term, STL Partner had tipped global API sales to reach $15 billion by 2026. Now, the firm believes that benchmark will be surpassed starting in around 2028.

“There’s a lot of complexity in terms of bringing this all to market,” said Amy Cameron, research director at STL Partners, told Fierce. “Eighteen months ago, we assumed more operators would have launched more APIs and more countries.”

Though API have been billed as a new way to monetize the various capabilities of their 5G networks, operators have been slow to figure out how to work collectively and with API aggregators. More broadly, they’ve been challenged to understand how to market what is, for them, a new product.

“For telecom operators, this is a new type of service, completely different from selling mobile data plans. It’s a matter at this point of building up experience,” Cameron said.

Still hope

But green shoots have emerged that suggest the long-term opportunity for mobile network APIs remains robust. Location and identity-focused anti-fraud APIs are proving most popular early on. And operators continue to work with — and share revenue with — large aggregator platforms including GSMA Open Gateway and CAMARA to develop these APIs.

Cameron highlighted TikTok’s use of the Number Verification API in Brazil, which shaves an average of 12 seconds off the customer signup process by removing the SMS user authentication step.

“TikTok is proving this is working in Brazil,” Cameron explained. “And when that capability is available elsewhere, others will be keen to use it.

Meanwhile, location-based APIs are proving popular early on with financial institutions that want to make sure, for example, that a consumer’s phone is actually in the same country where their credit card is being used to make a large purchase.

But Cameron also noted there’s more direct revenue potential from APIs that deliver insights on an individual networks’ quality and performance. These APIs are free of revenue-sharing attachments.

“Operators should consider some network APIs as their own IP and pursue direct channels there to retain a larger share of the revenue,” she suggested. “These types of APIs — including quality on demand and network performance information — are often more complex to deliver due to them exposing a capability that instructs or changes the network. Given this complexity, an important part of the telco IP will be integrating the APIs into broader enterprise solutions — for example, for autonomous vehicles or content distribution.”

Beyond anti-fraud, STL Partners forecasts the next most valuable use cases to be in advertising and marketing, autonomous vehicles, IoT, enterprise IT, and entertainment and content distribution.