- Wireline tech is still king in state BEAD awards, as Comcast came ahead of other large ISPs

- SpaceX and Kuiper won more locations than any wired operator – but less funding

- States must now play the waiting game for NTIA’s response

The Broadband Equity, Access and Deployment (BEAD) program process is chugging along, as roughly half of the 56 states and territories have now released deployment plans and grant awards. While fiber remains the preferred technology, it’s a cable operator that’s amassed the most funds so far.

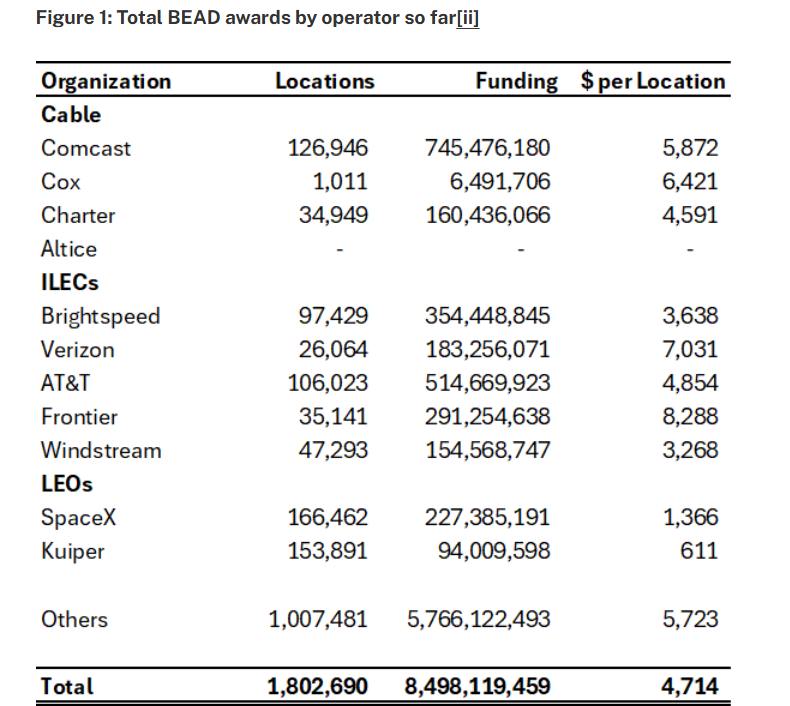

Comcast came out on top of the other large wireline operators, scoring $745 million to cover approximately 127,000 locations across 25 states, per New Street Research’s analysis. The company plans to use a mix of fiber and hybrid-fiber coax (HFC) for its BEAD bids.

Given deploying HFC is cheaper than end-to-end fiber, NSR expects more cable companies to participate in the program. Charter meanwhile received just $160 million for 35,000 locations, though the operator has said it intends to spend less on BEAD than it did for Rural Digital Opportunity Fund (RDOF) projects.

In terms of where the other wireline ISPs stand, AT&T is not far behind Comcast with a total of $515 million for 106,000 locations. Other big wireline winners were Brightspeed ($354 million), Frontier ($291 million), Verizon ($183 million) and Windstream ($155 million). T-Mobile, which is starting to dive deeper into fiber, is part of the Louisiana Local Fiber Consortium, which bagged $378 million in that state.

Although NTIA nixed the Biden administration’s fiber preference for BEAD, most states so far still favor fiber and wireline over fixed wireless access (FWA) and satellite. That’s because NTIA’s definition of a “priority broadband project” gives states some wiggle room to determine if a technology meets the BEAD requirements.

Satellite snags more BEAD locations

Satellite providers thus far have won less funds than expected under the new BEAD rules, as SpaceX’s Starlink and Amazon’s Kuiper received a total of $227 million and $94 million, respectively.

Despite the smaller share of funding, Starlink and Kuiper notably won more locations than any wired operator, getting 166,000 and 154,000 apiece. SpaceX has called out Louisiana and Virginia for not awarding more funds, but the company has yet to challenge any other state BEAD plans.

BEAD funds thus far have been allocated to a total of roughly 1.8 million locations, as companies that offer fiber won 68% of locations, NSR noted, followed by satellite (18%), FWA (12%) and cable (2%).

The official deadline for states to submit their BEAD proposals is September 4, but it’ll be a while longer before we see the final technology breakdown. NTIA has given extensions to at least five states, including California and Texas that were allocated the most funds.

With 1.8 million locations already accounted for, there may not be many BEAD-eligible areas left on the table. A study from the Advanced Communications Law and Policy Institute (ACLP) showed that overall BEAD locations declined 65% in the last three years, from 12 million to 4.2 million.

NTIA's next move

The biggest question around BEAD is whether NTIA will approve state plans or require states to make more changes down the road.

Approval will likely hinge on whether NTIA will apply BEAD’s “reasonable cost” cap broadly or on a state-by-state basis, said NSR Policy Analyst Blair Levin in a note. He thinks the latter is more probable, where western states may have a higher cap (say, $15,000 per locations) than eastern states (generally below $10,000) since it’s typically more expensive to deploy broadband in the western U.S.

But requiring any substantial adjustments might derail Commerce Secretary Howard Lutnick’s goal of disbursing BEAD money by the end of the year, Levin noted.

“As the state plans achieved what we think of as Lutnick’s primary objective—spending far less and doing so more quickly and smoothly than the prior Biden team—he may simply sign off on the plans with very modest changes in some states, such as disallowing certain still-costly proposed awards on a case-by-case basis,” he said.