- Brightspeed is shifting from its build phase to a more “customer-centric” strategy, said CEO Michel Combes in an exclusive interview

- Doubling down on AI and self-service tools is part of that plan

- But it’s still going full steam on fiber builds, using private capital and BEAD funds

Brightspeed has been a busy bee with fiber, regularly announcing deployment completions across its 20-state footprint. While the company has no intention of slowing down its build, that’s no longer Brightspeed’s top-of-mind growth objective, said new CEO Michel Combes in an exclusive interview.

Combes, who took charge of Brightspeed in June following the retirement of former CEO Tom Maguire, told Fierce his goal in the last 90 days has been to shift Brightspeed from its build phase to become more “customer-centric.”Prior to joining Brightspeed, Combes served as chief executive for several telecommunications firms, including SoftBank, Sprint and Vodafone Europe.

After Brightspeed acquired Lumen’s ILEC assets in 2022, the first few years of operation revolved around “setting up a build machine,” Combes explained. As a private company, Brightspeed doesn’t disclose its customer count, but the operator has passed more than 2.4 million locations with fiber to date.

Now that Brightspeed's customers are coming online, the company needs to keep them. Brightspeed is trying to improve each leg of the customer experience, from when the customer places an order to when they gain access and so on, Combes said. Increasing speeds is another priority, as Brightspeed currently offers up to 2 Gbps service but intends to eventually roll out 5-gig and 8-gig tiers, he noted.

However, merely ensuring the network is up and running isn’t enough.

“As a telecommunications infrastructure company, we had this mindset of saying, okay, my KPIs show that the customer should be happy, meaning at the end of the day the network does work,” Combes said. “Maybe the network was working, but their CPE was not working, their Wi-Fi at home was not working.”

AI is unsurprisingly one piece of the puzzle in improving customer experience. Brightspeed is using AI to not only route customer service calls but also to decide whether to install aerial or buried fiber.

“Because if we know when we take the order, whether it will be buried or aerial in a very accurate manner, then you can commit yourself to a time frame which is not going to change,” he said.

Brightspeed is doubling down on self-service applications, Combes said. For example, the company this month launched an online platform to help businesses more efficiently place and personalize their internet orders.

“At the end of the day, my intent is to limit as much as we can the calls to the call centers,” he said. “We should be able to be much more proactive; we should be able to give [customers] the information that they need.”

Brightspeed’s BEAD plan

Despite the newfound customer focus, Combes said Brightspeed’s current build pace won’t change, and it’s got the cash on hand to do so. The company in August announced it raised another $1.65 billion in capital to fuel its goal of reaching more than 5 million fiber locations in the coming years.

He touted Brightspeed’s private financing, in combination with its Broadband Equity, Access and Deployment (BEAD) grants, as “a kind of recognition of [the company’s ability] to really deliver.”

“All the money that we raise is earmarked to build,” said Combes. The cash Brightspeed generates from network operations “helps us also to modernize operations,” such as replacing copper with fiber and fixed wireless service.

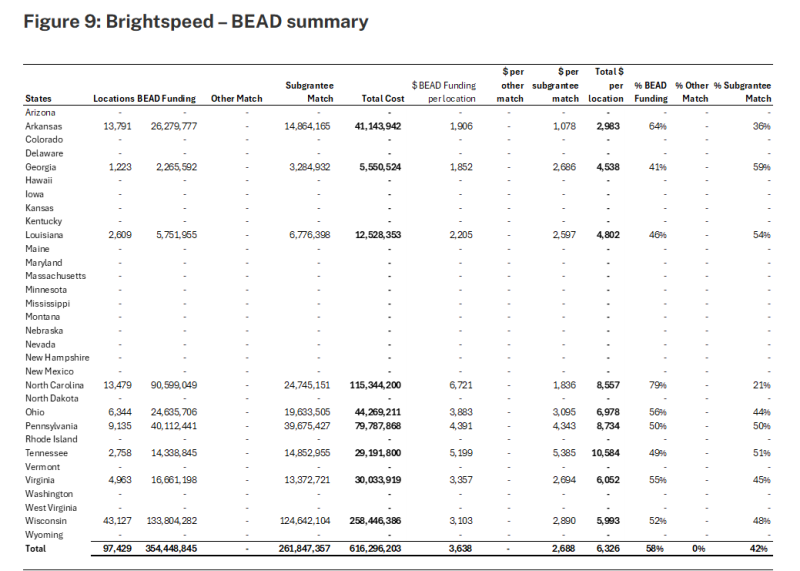

Brightspeed thus far has been awarded about $354 million in BEAD money to cover 97,000 locations in 9 states. The company is expected to invest just under $2,700 per location for the buildout, according to New Street Research.

Though BEAD no longer has a fiber preference, most states still plan to dole out most of their funds to wireline operators. Besides Brightspeed, other big-name providers that won grants include Comcast, AT&T, Frontier, Verizon and Windstream.

“Given how low Brightspeed’s current fiber build cost has been, we wouldn’t be surprised if the actual build cost for these BEAD locations came out to be significantly lower than estimated,” said NSR analyst Vikash Harlalka in a note this week.